4 Benefits of Hiring an Employment Law Attorney There are two types of employees: clock-watchers and “overtimers.” For hard workers, there’s a clock-watching misconception. If you’re not tracking your time, you may believe you’ve missed out on the pay for those unaccounted hours. What’s worse, as a salaried staffer you might believe you aren’t entitled […]

Religious Freedom or Discrimination: Can My Employer Decide What Benefits I Can Get?

The recent landmark Supreme Court case Burwell v. Hobby Lobby has led many to question what benefits businesses can deny their employees based on religious beliefs. Some critics argue that the ruling, which favored the corporation’s right to deny female contraceptives through its insurance policy based on religious freedom, actually discriminates against the values of […]

Can an employer deduct hours from my paycheck?

According to the Bureau of Labor Statistics, the average American adult spends 8.8 hours daily working – that’s more hours spent than those on sleeping and other household activities combined. What’s more alarming: 31 percent of all single-job employees work on weekends, as well. Is your employer giving you the proper credit for all your […]

New overtime rules for salaried workers on the way

In most parts of the country, a salary of $24,000 a year doesn’t get you very far. But if you are a salaried employee making that much or more, and are classified by your employer as an administrative, executive or professional employees, you are not legally entitled to overtime pay. Think for a minute about […]

Wage payment laws in Florida: what are the facts?

It’s not always easy to know if you’re being paid in compliance with state and federal laws. Some employers intentionally try to confuse or even intimidate their workers into accepting a lower pay rate than the law allows. The best way to prevent that from happening is to know your rights under the law. We’ve […]

Wenzel Fenton Cabassa, P.A. Named To Best Law Firms List For 2014

Employment Law Firm earns high praise from clients and peers for second year in a row NOVEMBER 15, 2013 (TAMPA, FL) – Wenzel Fenton Cabassa, P.A. has been named to US News & World Report’s “Best Law Firms” list for 2014 in recognition of its professional excellence in the field of employment law. The firm […]

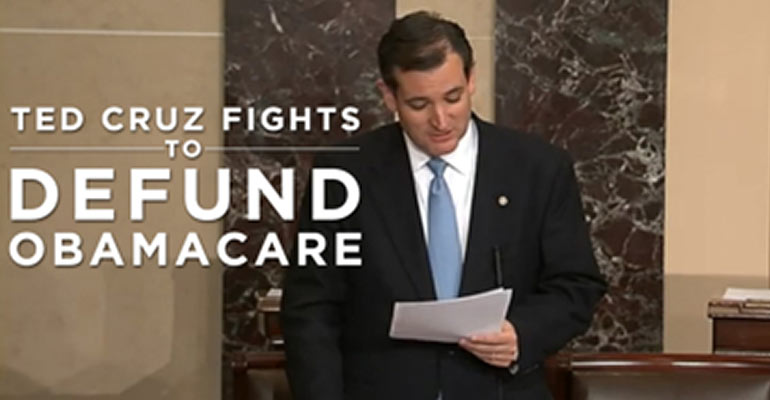

How Does Obamacare Affect Small Business Employees?

“It is the single biggest job killer in America.” “Americans all over this country are suffering because of Obamacare.” “If we are really serious about stopping Obamacare, we’ll destroy the entire planet.” All comments made by Sen. Ted Cruz (R-TX) regarding Obamacare in just the last month. And whether you’re listening to the political rhetoric […]