Common FLSA Violations & Cases [Infographic]

Updated January 23, 2019

More than 143 million American workers are protected by federal law. Has your employer committed an FLSA violation? Under the Fair Labor Standards Act, your case may be protected from these common violations of employee rights.

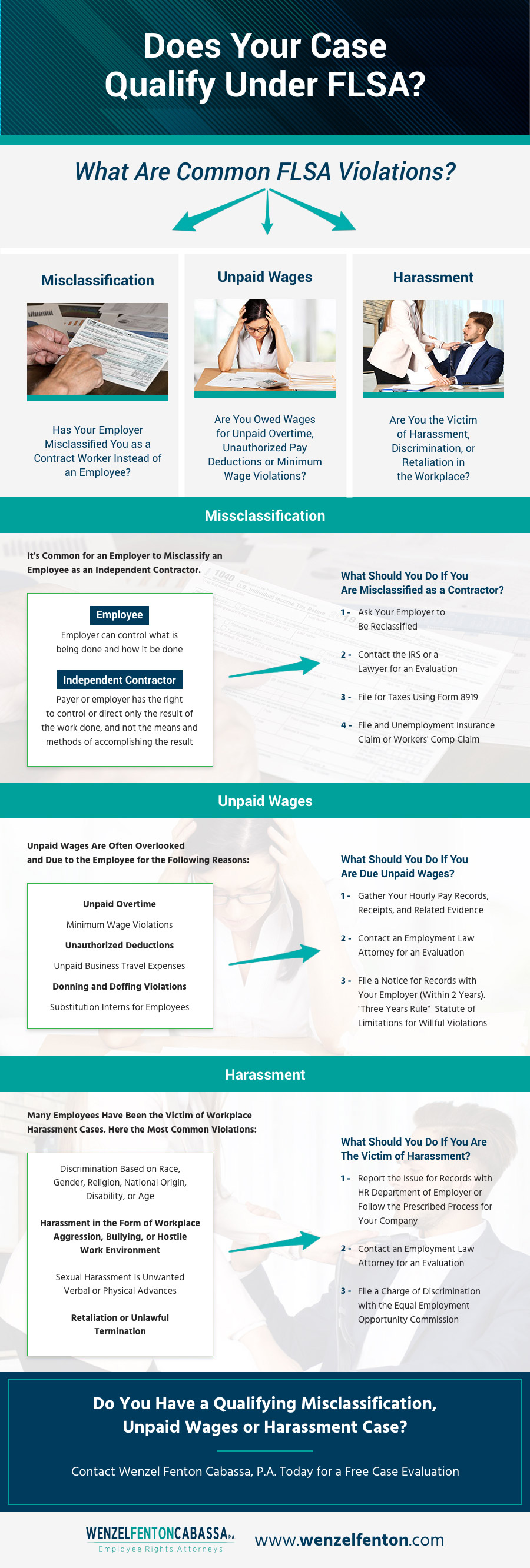

What are some common FLSA Violations?

There are many types of employment law cases that violate current regulations to include Employee Misclassification, Unpaid Wages, and Harassment. You may be entitled to benefits from your employer, missing money owed, and/or a settlement as the result of discrimination. FLSA damage awards can be quite substantial. They are there to hold employers accountable for unlawful and unfair actions and to allow employees to seek justice.

If you believe that your FLSA case qualifies under one of these conditions, take a look at the best actions to take regarding your employee rights.

Sometimes, these FLSA violations are just plain mistakes (such as misclassification). Other times, it is intentional and an egregious Fair Labor Standards Act violation. Wage and Hour violations occur all the time across many industries including hospitality, retail, and healthcare. Wage and Hour violations penalties may also include an equal amount of liquidated damages.

For example, if your employer failed to pay you $1,000 in overtime wages you legally qualified for, then the FLSA provides you may be awarded liquidated damages of $1,000 — for a total of $2,000. In addition, FLSA violations can also tack on more penalties if you have been retaliated against (like getting fired) for reporting unlawful actions such as unpaid overtime.

Does your case qualify under FLSA?

The complexities of the FLSA are sometimes confusing. Here are some common questions and answers:

What is FLSA Status Exempt?

An employee that is properly classified as “exempt” does not qualify for overtime pay based on a the duties they perform and whether they are actually paid a salary. The exempt employee must meet both tests. Exempt employees are typically in administrative, professional, and executive roles. There are also exemptions for computer-related professionals and some outside sales workers that spend most of their time away from the office.

Who is covered under the FLSA?

As mentioned above, more than 143 million workers in the United States are covered. The Department of Labor, the federal agency that administers the FLSA, divides the coverage into Enterprise and Individual categories.

Enterprise: employees working for an organization or business that have at least 2 employees and have an annual dollar volume of sales or business of at least $500,000 or hospitals, businesses providing medical or nursing care for residents, schools and preschools, and government agencies.

This includes teachers and teaching assistants, medical assistants, people working in nursing homes, and more.

Individual: employees whose work is involved in interstate commerce — stated on the DOL website as “engaged in commerce or in the production of goods for commerce.” This can include factory workers, secretaries, or other workers where goods are produced for shipment outside of the state Or the employee is otherwise engaged in interstate commerce (such as processing orders or credit card charges for goods shipped across state lines).

Taking Action for Employee Rights and FLSA Violations

Do you believe you have a qualifying case under FLSA? Wenzel Fenton Cabassa, P.A., has helped thousands of employees who have had their legal rights violated. We fight hard for justice and work diligently to hold employers accountable for FLSA violations. You may be not only able to get back thousands of dollars of unpaid wages, but you may also qualify for wage and hour violations penalties equal to the amount of your unpaid wages.

The Fair Labor Standards Act exists for your protection against harassment — and as a legal authority for your employer to provide you with a fair wage. If you believe you have been misclassified as exempt, denied the right to minimum wage, denied overtime for legitimate hours worked, or other areas covered by the FLSA, contact us for a free consultation.

Wenzel Fenton Cabassa, P.A. is a top law firm helping employees get the workplace justice they deserve. It is important to contact an experienced attorney as soon as possible if you believe you may have a case. There are statutes of limitations, and you could lose the right to receive unpaid wages and potential liquidated damages for FLSA violations if you do not take action in a timely manner to protect your rights.

Please Note: At the time this article was written, the information contained within it was current based on the prevailing law at the time. Laws and precedents are subject to change, so this information may not be up to date. Always speak with a law firm regarding any legal situation to get the most current information available.