Do You Qualify for Unpaid Overtime?

One of the most common employment law cases today involves claims against employers who owe employees unpaid overtime wages. It happens in many different industries from retail to construction and education to healthcare.

Workers across the United States are protected by a federal law that guarantees overtime pay. This law is The Fair Labor Standards Act (FLSA). It mandates employers to pay one and a half times your regular rate of pay for all overtime hours. If you have worked overtime and not received the proper pay, you may be entitled to compensation through a wage and hour claim.

WHO QUALIFIES FOR OVERTIME PAY?

The overtime provisions of the FLSA have broad application:

“All employees of certain enterprises having workers engaged in interstate commerce, producing goods for interstate commerce, or handling, selling, or otherwise working on goods or materials that have been moved in or produced for such commerce by any person.”

This includes hospitals, schools (from preschool to higher education), workers in public agencies, and enterprises “whose annual gross volume of sales made or business done is not less than $500,000.” This means that a smaller business with less than $500K gross sales is not obligated to pay overtime under the FLSA enterprise coverage rules. However, the FLSA also provides that an individual employee may be covered by the FLSA if their work regularly involves them in interstate commerce. Some examples include a factory worker who assembles products for shipment out of state or employees who regularly travel out of state for work.

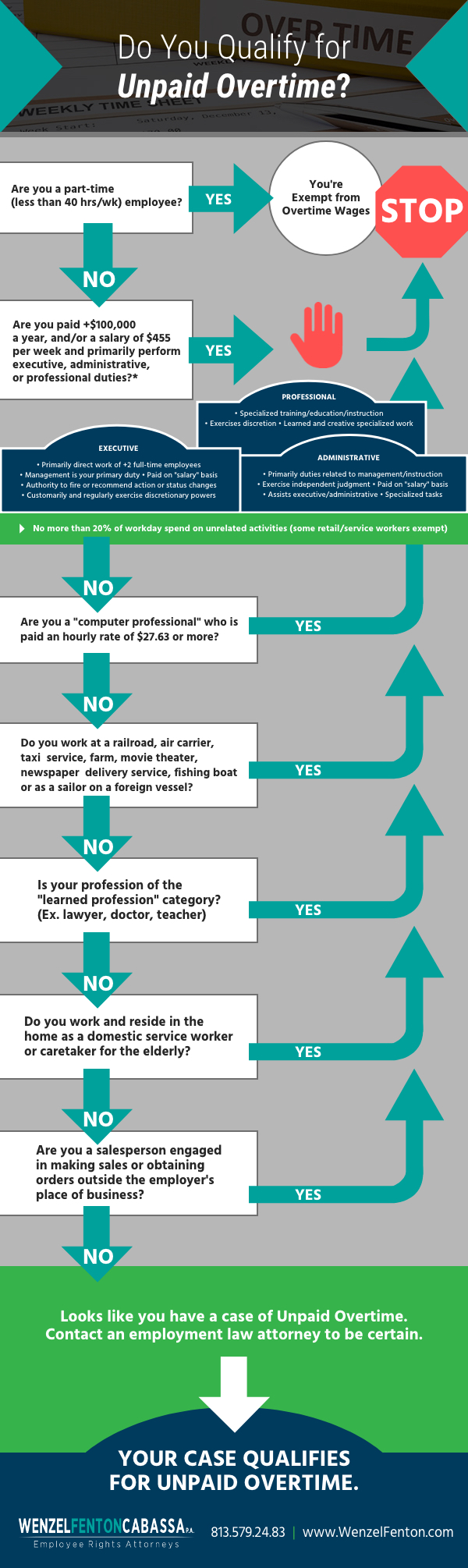

There are some exemptions to the law.

Certain types of employees and roles in the workplace are exempt from overtime wages. This includes executive, professional, and administrative roles. Generally, these exemptions from overtime require advanced education or skills, exercise of independent judgment or management of the work of more than two other employees as one of your primary duties. If you are unsure of whether or not your employer owes you for unpaid overtime, take a closer look at some of the conditions that could make you exempt.

Filing an Unpaid Wages Claim

Employee rights attorneys understand the complexity of the FLSA and work with people just like you to recover pay that you rightfully deserve. Do you think you qualify for unpaid overtime? Gather any relevant documentation like paycheck stubs, work schedules, employee handbooks, or other pertinent information that can help prove your case.

Many employers will try to intimidate workers and say they don’t owe you the pay, didn’t approve the overtime or say that you worked unscheduled hours. This is often a tactic used to get more work out an employee to save money on their operating budgets and boost their profits. But know that many employees are protected under FLSA — and you may have a valid case.

If you win the case, you may receive:

- Unpaid Overtime – you may be able to collect 1½ times your regular rate (which also applies to some salaried positions) – for the time that you worked above 40 hours

- Liquidated Damages – Liquidated damages are penalties that double the amount you are paid; for example if you are owed $5,000, you receive $10,000

- Legal Fees – If you win, your employer must pay the full cost of for your employment law attorney under FLSA guidelines

It is important to contact an employment law attorney sooner rather than later because there is a statute of limitations on filing an FLSA claim. Some employees work for an employer for a really long time and never hold them accountable for not paying overtime. That’s a mistake. The statute of limitations on FLSA claims is generally two years, but it does extend to three years if a jury finds that an employer willfully violated the statute.

Employers have their lawyers and you have the right to legal representation too. Who qualifies for overtime pay and the complexities of proving an FLSA claim can be confusing. That is what we are here for and we want to help.

Do you believe you qualify for unpaid overtime? Then contact Wenzel Fenton Cabassa, P.A. for a free consultation, and let us handle your case. We’ve helped thousands of people hold their employers accountable for their unlawful actions — fighting for the rights of employees across the state of Florida.

Other unpaid overtime and FLSA articles:

My Employer Is Not Paying Me Overtime. Due I Sue?

How To File An Unpaid Wages Claim In Florida

How to Calculate Your Unpaid Overtime Wages

9 Reasons To Hire An Employment Law Attorney To Recover Your Unpaid Wages

Last updated December 6th, 2018

Please Note: At the time this article was written, the information contained within it was current based on the prevailing law at the time. Laws and precedents are subject to change, so this information may not be up to date. Always speak with a law firm regarding any legal situation to get the most current information available.